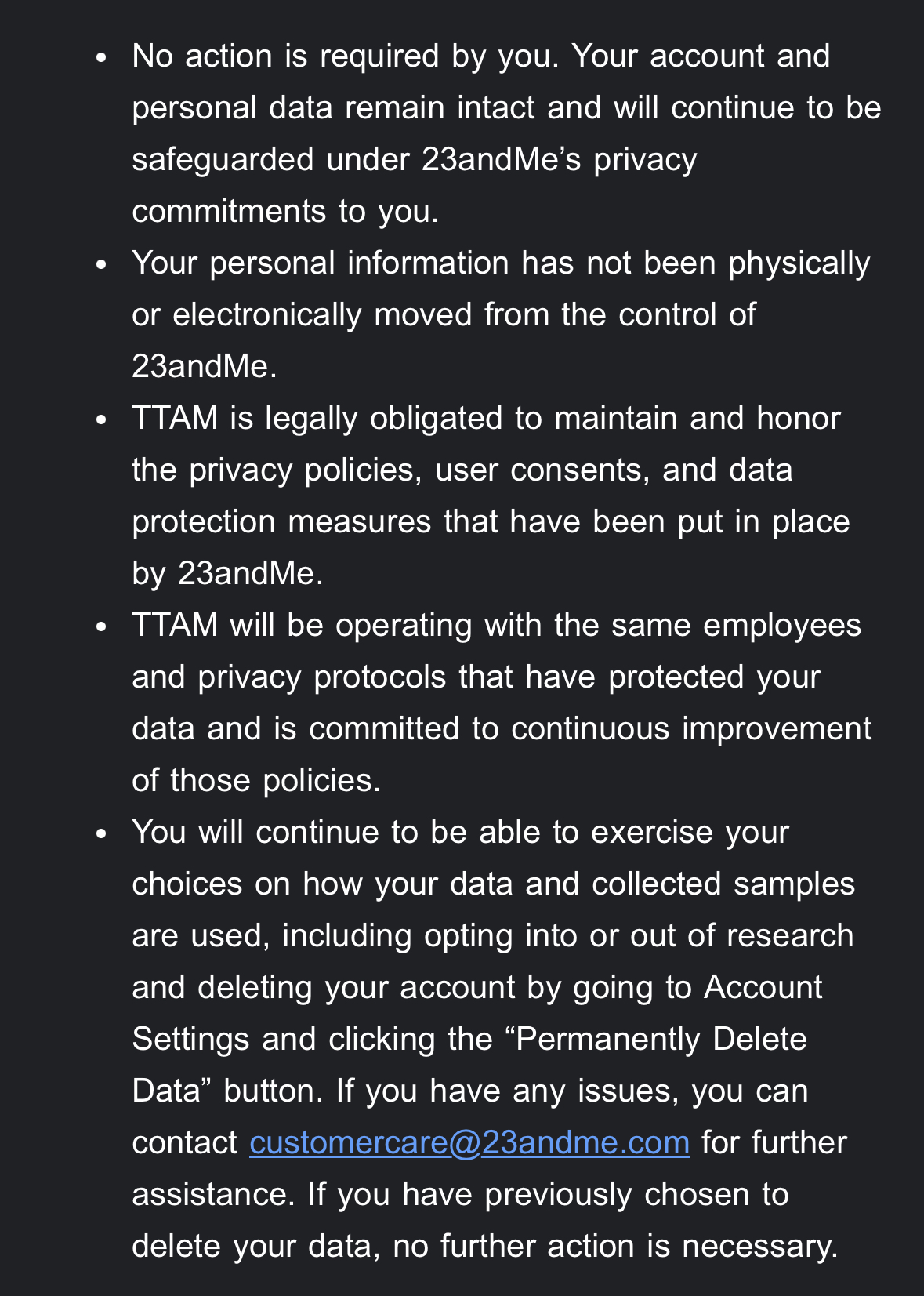

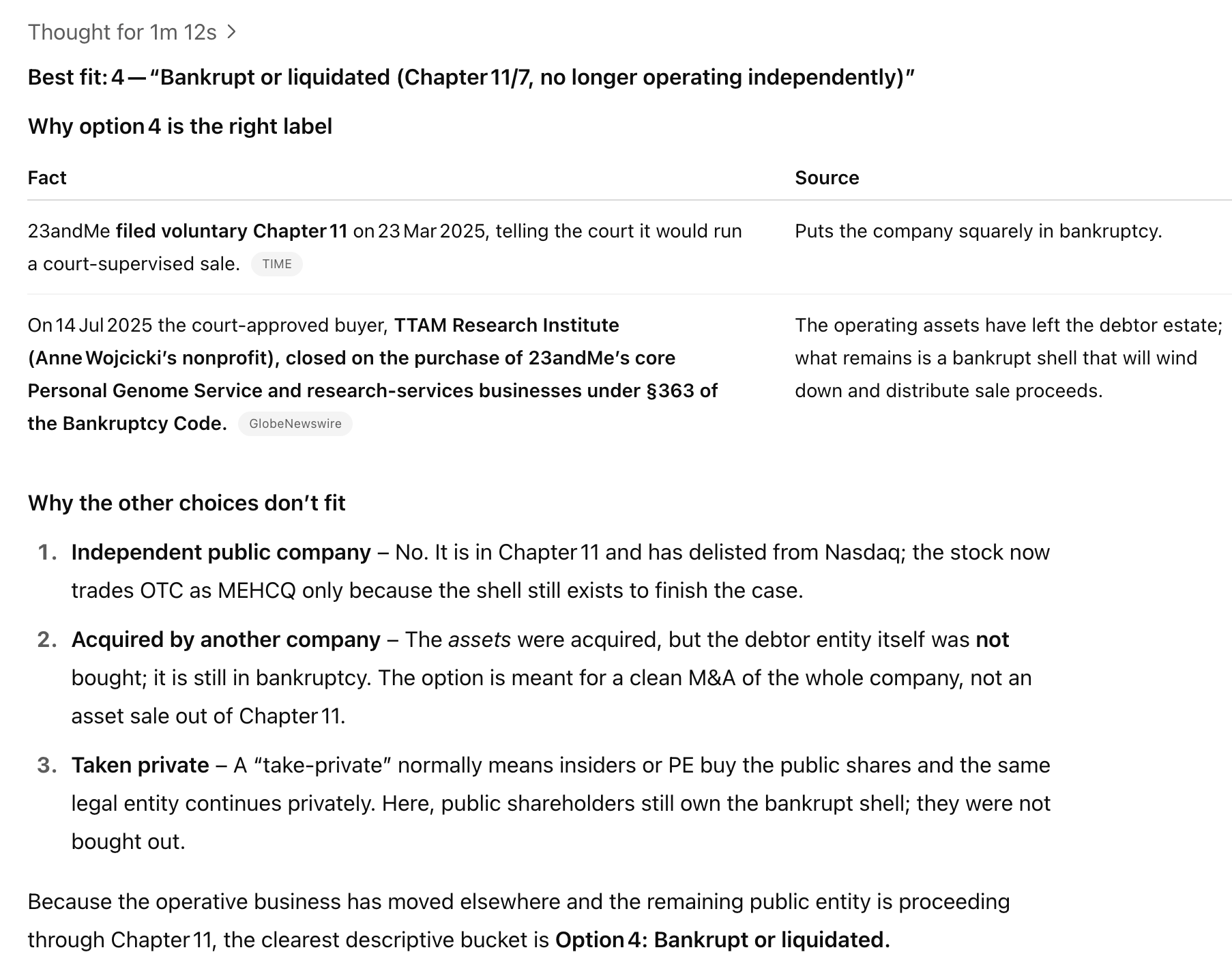

Update 2025-07-03 (PST) (AI summary of creator comment): In response to user questions, the creator has stated that for the 'Bankrupt or liquidated' answer, a sale of the company's assets will be considered a liquidation.

Asset sale is finalized: https://investors.23andme.com/node/10501/pdf

I'm not going to pretend to know the nuances of bankruptcy proceedings but I asked o3:

https://chatgpt.com/share/68787caa-4a38-8011-9a40-e6e9f854e8a1

@Sketchy But as I mentioned below given the underspecified options a prob resolution wouldn't be the worst. https://chatgpt.com/share/68787caa-4a38-8011-9a40-e6e9f854e8a1

o3 suggests 70/30 for 4/2 when I ask - efficient market hypothesis at work?

@Quillist I believe only the assets of 23andMe are getting sold to TTAM, and it is being done under Chapter 11. The company itself is not going private or being acquired, it will no longer exist.

today announced that it has received approval from the U.S. Bankruptcy Court for the Eastern District of Missouri (the “Court") for the sale of substantially all of the Company's assets and ongoing business operations to TTAM Research Institute

@Sketchy Seems like really bad resolution definition, I originally took a position understanding that 23andme had already entered chapter 11 a month before this market was even created. Why make the market if it was already going to be bankruptcy